The money is cheaper than ever before.

Political uncertainties, deteriorating oil prices, loose monetary policies, embraced by the central banks worldwide to assist struggling real economy, and slowing economic growth of emerging BRICS countries are some of the main drivers of change within the financial industry.

So the question that worries all investors and market participant is: where to invest?

Background

As William Gross from Janus Capital suggested, we live in a new normality. But while old paradigms are getting out-dated, what will they be replaced with? What kind of opportunities to expect in 2015 and beyond? And how to prepare for them?

“Cheap money: easy borrowing, tough investing?” was the key topic at Campus for Finance 2015 in Vallendar, Germany. This is the 15th edition of the leading conference in finance in Europe that is arranged by students of WHU Otto-Besheim School of Management. With keynote speakers representing such organisations as BlackRock, Rothschild, Goldman Sachs, Bank of America Merrill Lynch, Bank of International Settlements and others, last year highlights and emerging trends for 2015 and beyond were discussed.

The trends

Global economic recovery to remain shaky

Jaime Caruana, the General Manager of Bank for International Settlements (BIS), kicked off the conference by stating that the world is still recovering from the consequences of the 2007-2009 financial crisis. “The situation remains complex, and those who say that they clearly understand what is going on, either lying or just don’t have enough information at hand.”

“Public debts grew by 40% globally, while the private sectors debt has seen a decline of 5%.” – Jaime Caruana, GM of BIS

He also shared his concerns that the public debt remains high; however, companies and households are deleveraging. That means that they are paying off their previous debts instead of spending more. “We need to incorporate finance into the real economy, yet these two concepts don’t integrate well.”

“Deleveraging? What deleveraging?” – Jaime Caruana, GM of BIS on the accelerated increase of public debt

The top executive concluded that liquidity is necessary to support the real economic growth globally, but he is certain the interest rates will see an increase in the middle-term.

Monetary policies among developed countries are going to diverge

What is good for the US might be unhealthy for Europe. That is, shall low interest rates remain at all-time lows, the classic banking model will be destroyed. “If people who place money on a bank deposit will not see positive returns, expect them to withdraw funds and invest elsewhere.” – Prof. Hans-Peter Burghof from Unversity of Hohennheim suggests. – “If banks don’t make any changes to their business models – German banks in particular – then bank runs across Europe will be inevitable in the upcoming decade.”

At the same panel discussion, Prof. Markus Leippold from University of Zurich pointed out that there is not enough productivity capacity among European companies. “This makes no space for the money to flow in, so new economic and business models need to be introduced.”

Dr. Thomas Groffmann, COO of BlackRock Germany, acknowledged this as well, adding that this problem is complicated by diversified policies and growth rates among European member states. That is contrary to the US, where the policy is uniform nation-wide. “It will take a long while till the rates will improve. – Mr. Groffmann concludes. – “We are expecting that the US economy will experience further growth, and this year will be a big year for the American dollar.”

M&A is becoming a hot topic again

As the stocks markets have enjoyed a bullish trend all over the world, this was a triggering factor for more company mergers and acquisitions.

“The mediocre years of M&A are over.” – Wolfgang Fink, Co-CEO of Goldman Sachs Germany & Austria said. – “2014 was an exciting year. 2015 promises to see even higher number and sizes of deals to happen globally.” He also emphasized the fact that the M&A volumes are near pre-crisis levels, while in Europe a significant gap remains.

Bank of America Merril Linch holds similar expectations. “The EMEA region experiences a recovery of the transaction fees.” – Bob Elfring, Co-Head EMEA Corporate & Investment Banking at BofA/ML pointed out in his presentation. – “While it is far from reaching the pre-crisis levels, it would mean more earning opportunities will be available for investment banks.” Mr. Elfring also stated that bonds will remain an attractive investment in 2015, while equities are most likely to see a short-term correction in terms of valuation.

When the cross-border M&A volumes were discussed, Alexander Doll, Managing Director and Co-CEO of Barclays Germany, stressed out that 28% of M&A volumes occurred in Europe, with Germany and its industrial sector taking the lead in terms of the deals size. “The Americas are responsible for 50%+ of M&A volumes, while Europe has seen a decline.” – Mr. Doll stated. – “In EMEA, only 1-2 out of 10 M&A deals are closed. Why does this happen? I don’t know.”

A few words on commercial banking

Recent and prospective developments in the retail banking sector were also in focus of the conference speakers.

Anthony Saunders, Prof. of Finance, at NYU Stern School of Business, warned that the Basel III regulation risks turning banks into public utilities. “How? By reducing leverage excessively, limiting maturity intermediation and financial product innovation, and reducing bank ROEs.” – the professor summarized and suggested that “it [Basel] might need to be updated since it became too complex with excessive numbers of ratios that bring a loss of transparency.”

The importance of focusing on the digital distribution channel was highlighted multiple times during the conference. This way, banks will remain relevant and protect their core business from shrinking.

“Commercial banks need to focus on digitalization to survive.” – Frank Strauss, Chairman of Executive Board at Postbank accentuated. – “It will be vital to look at the periphery of the financial industry and look at the emerging solutions that come from startups or smaller financial firms.” The executive also confirmed that banks have to be open to innovation, and that responding slowly to the industry trends will only hurt the business.

Quick investment ideas for investors:

- M&A deals and their valuations are going to see a notable rise in 2015 in Europe, Middle East and Asia.

- The US dollar will be a big theme this year. US treasuries prices are expected to rise, too.

- Interest rates of the Central Banks worldwide are likely to significantly diverge. Hint: More arbitrage opportunities.

- Prolonged low oil prices will trigger mergers and acquisitions within the oil and gas industry.

- Short-term interest rate hike of the US Federal Reserve is highly unlikely in 2015. The accommodative monetary policy to hold both in the US and Europe.

Did you miss the Campus for Finance 2015: New Year’s Edition?

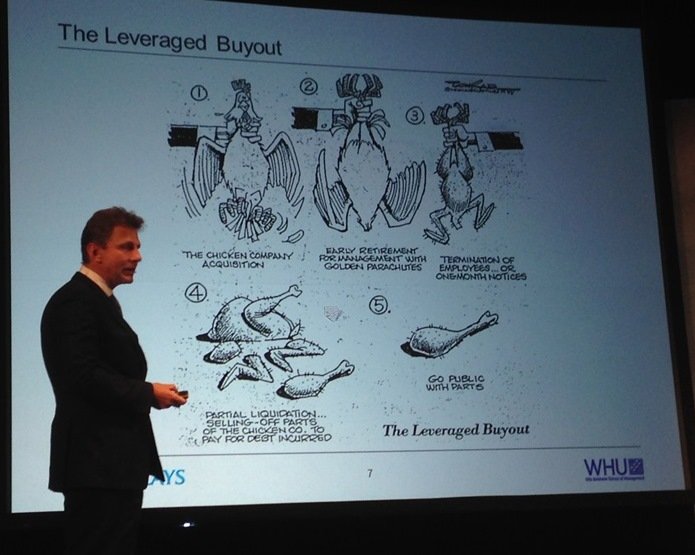

Apply to the Private Equity Conference till February 1, 2015.