There is little doubt that the European banking sector has undergone “cataclysmic” changes since the global financial crisis of 2007/08, which erupted in the US and quickly infected Europe.

A number of exogenous and endogenous parameters, including serious failures in risk management, inadequate capital and liquidity, among others, resulted in hundreds of billions of Euros of losses to shareholders, bondholders and on some very rare occasions, even depositors!

Moreover, as a result of this, Europe and especially the Euro zone, experienced unprecedented financial meltdown and extensive intervention by the authorities, who used the money of the taxpayer to bail out banks!

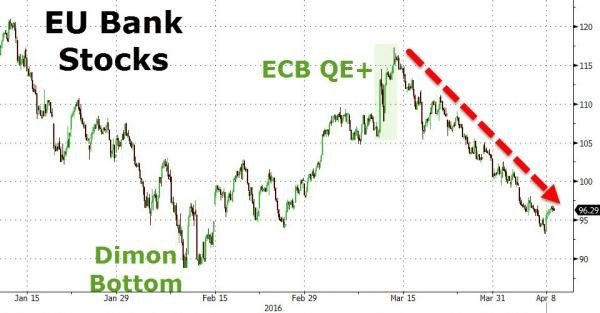

Share prices have been very volatile lately

So, the key question is where do we stand now?

Let’s start with the facts: so far this year share prices of European banks have been very volatile. On some occasions, we have seen price swings reaching double digit numbers! We need to understand why this is happening and whether the worries behind this are justified.

A more resilient European banking sector …

However, before we do that it is important to look at the “big picture” and note that over the past few years, banks in Europe have become much more resilient.

More specifically, the Common Equity Tier 1 ratio (that is to say the ratio of common equity plus retained earnings divided by risk weighted assets) of banks in the Euro zone has increased from just over 6% in 2007/08 to 12% in 2015, on average. This is of paramount importance, especially if we take into account that difficult times may be ahead of us.

This in turn, brings us to our earlier question of investor worries, which are mainly due to anaemic economic growth and a rather prolonged period of low interest rates. As a result of the combination of these parameters, banks’ profitability is likely to be seriously challenged.

This is obviously bad news for bank shareholders since lower profitability is likely to result in smaller dividend payments and share price stagnation. But it is not only bad news for the shareholders; this development is likely to give headaches to supervisors of European banks also. Why? Because concerned bank shareholders are not likely to be willing to invest more capital in the future – should the need arise – hence jeopardizing the stability of banks.

… though in a very challenging environment

So, what can the European banking sector do to tackle the issue of weak profitability?

Remember, we are in a period of a weak economic growth and very low interest rates! Could they search for a higher risk – higher return trade-off (e.g. establish weaker credit standards, rely more on short-term funding)?

Maybe yes, and some of them are probably doing just that, but entering riskier territories may end unpleasantly, as we very well know from the last crisis! And that is why European banking supervisors are closely monitoring each step the banks take in their attempt to tackle this challenge.

Alternatively, banks could change their business model and place more emphasis on their non-interest activities, i.e. complement lower interest income with other fees. A third possibility would be to become more efficient, that is to say cut their operating costs.

And this is not all!

There is a number of other risks that European banks need to take account of. Such as very high levels of non-performing loans in some countries, corporate governance risk, sovereign risk and geopolitical risk. In particular, non-performing loans are likely to be a crucial issue since losses stemming from them may have a direct negative impact on the capital ratio.

As such, it is not surprising that European banking supervisors are closely reviewing the situation of those banks affected most, paying particular attention to concentration of excessive risk in certain areas (e.g. real estate).

Banking regulators have a crucial role to play

Obviously regulators have done a lot since the financial crisis and that is why banks nowadays have to comply with higher regulatory requirements and stricter supervisory standards.

This, as we have already noted, translates to them holding a lot of additional capital, the objective of which is to act as a “buffer” against any possible future shock.

However, the risk of default is an indispensable part of any proper market economy hence regulation on its own can do so much! Nonetheless, there are essential things that regulators must adequately take care of:

Firstly, they should make sure that the failure of any bank will not destabilize the entire system (as happened last time around). Secondly, they should ensure that the costs of such a failure will be undertaken by those who decided to take the specific risk (i.e. shareholders and bank creditors).

This effectively means that the “too big to fail” argument is left in the past and with it, the idea of the public bailing out the banks.