Hold onto your hats, crypto enthusiasts! Bitcoin is gearing up for its much-anticipated “Halving” event. The next Bitcoin (BTC) halving is likely to occur in April 2024 and could have a dramatic impact on the cryptocurrency’s price.

Halving is a process that happens every four years, where the reward for mining new bitcoins is cut in half. This means that the supply of new Bitcoins is reduced, making them more scarce and more valuable.

The halving cycle is expected to continue until all 21 million Bitcoins have been mined. This is estimated to occur in the year 2140. At that point, the reward for mining will be solely comprised of transaction fees.

Imagine a baker who is known for producing delicious bread. The bread is so popular that people are willing to pay a high price for it.

The baker, in order to maintain the quality and desirability of the bread, decides to limit the amount of bread that is produced each day. This ensures that the bread remains scarce and valuable.

The Bitcoin halving is similar to the baker’s decision to limit the production of bread. By reducing the amount of Bitcoin that is created each year, the halving helps to ensure that Bitcoin remains a scarce and valuable asset.

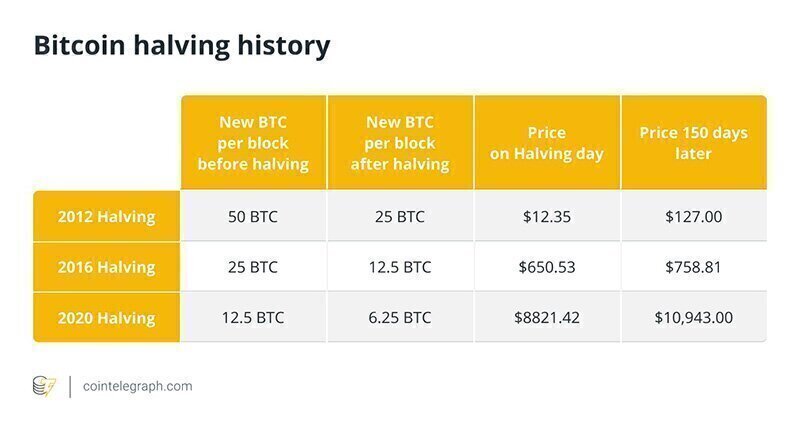

When Bitcoin was first introduced, miners received 50 BTC as compensation for verifying transactions and adding new blocks to the blockchain.

This generous reward served as an incentive to attract early adopters to the network and contribute to its growth. For many of us those were the glory days of crypto.

This impending halving is expected to trigger a surge in demand for digital assets. Brace yourselves for a rollercoaster of scarcity, skyrocketing prices and a wave of new opportunities in the crypto realm. Oh and did I mention FOMO? Add that in.

Savvy investors are meticulously assessing promising crypto projects. Those who stay on top of these developments can identify early-stage projects with high potential. The return on the right investments can be life changing.

“The future of finance is digital. And Bitcoin is leading the way.”

— Michael Saylor

What happened the last time Bitcoin halved?

In the last halving on May 11, 2020, Bitcoin’s price witnessed a remarkable rally, soaring from $6,877.62 in April to $8,821 at the time of the event. Despite the inherent volatility of the cryptocurrency market, Bitcoin’s price continued to climb, reaching a staggering $49,504 on May 11, 2021.

This pattern of post-halving price appreciation has been observed in previous halvings as well. In 2012 and 2016, Bitcoin’s price experienced a similar trajectory, with the strongest gains occurring after the halving events.

While there were significant drops in value around 12–17 months later, Bitcoin’s price remained considerably higher than pre-halving levels, suggesting a long-term bullish trend.

Market Dynamics Unleashed

As Bitcoin dances through the halving, the market does a happy jig. Prices surge, demand skyrockets, and guess who steals the spotlight?

Peripheral services!

From coins to tokens, projects to dreams — the market resurrection after the crash opens doors for the bold and the curious.

There is a lot happening in crypto right now.

Binance CEO Changpeng Zhao (CZ) has recently stepped down, pleading guilty to violating anti-money laundering requirements. This is a shocking fall from grace for the leader of the world’s largest cryptocurrency exchange.

Binance, as part of the deal, will pay regulators and prosecutors penalties of $4.3 billion and also plead guilty to criminal charges relating to money laundering, conducting an unlicensed money transmitting business, and sanctions violations.

Zhao also agreed to pay a $50 million fine. He is barred from involvement in Binance’s business until three years following the appointment of a monitor to ensure Binance complies with all laws, according to court documents. But he was allowed to maintain his majority ownership of the exchange.

But hold your breath —

We’re also in the thick of Bitcoin ETF approval talks. A flood of filings for spot Bitcoin and Ether exchange-traded funds (ETFs), has excited the crypto market.

A spot crypto ETF would track the market price of the underlying crypto asset, giving investors exposure to the token without having to buy the currency. The SEC has previously denied all spot bitcoin ETF applications citing potential for fraud, but that could soon change after it lost a legal battle in August. UPDATE: earlier this month, the SEC has approved the use of Bitcoin ETF.

And that’s not all!

The oracle whispers of a looming Bull run. Experts are dusting off their crystal balls, predicting a surge that could redefine the crypto landscape.

Can you keep up with the crypto rollercoaster? We’re still awaiting the sentencing of SBF for his fraudulent FTX activities.

“In the world of crypto, every Halving is a rebirth, a chance for new dreams to take flight. Embrace the scarcity, ride the surge, and let the Bull run set the stage for your crypto adventure!” — Norm

In the treacherous realm of fiat currencies, central banks often wield the dangerous weapon of overprinting. The money machine relentlessly churns out new bills. This leads to a gradual erosion of its value.

Bitcoin, on the other hand, halves due to the design of its software. The still unidentified and mysterious founder Satoshi Nakamoto predetermined a maximum of 21 million coins. This scarcity sets a natural limit on inflation, ensuring that the value of Bitcoin is not subject to the whims of central banks.

This scarcity also leads some to criticize Bitcoin’s design. These observers feel the finite supply and halvings encourages users to save (HODL) rather than spend their Bitcoin. This contributes to the volatility because users only hoard coins to cash out at key levels.

Embrace the digital revolution and seize the opportunity presented by Bitcoin’s halving. Nearly 89% of those 21 million Bitcoin that can ever exist have already been mined. Approximately 900 new Bitcoin are mined and added to the digital supply each day.

How do you get ready?

To fully unlock the boundless potential of the halving, it is essential to approach it with a well-informed strategy.

For miners, the halving will necessitate a strategic shift to adapt to the changing incentives. Competition for the reduced block rewards will intensify, demanding greater efficiency and innovation in mining operations. Miners will need to explore alternative revenue streams, such as transaction fees and pool fees, to maintain profitability.

Crypto enthusiasts can capitalize on the halving by conducting thorough research and making informed investment decisions. Identifying promising digital assets with strong fundamentals and long-term growth potential is crucial for navigating the post-halving market. Diversification across different asset classes can further mitigate risk and enhance portfolio resilience.

Founders and developers should actively engage with their community. Be sure to address their concerns and foster a collaborative environment. As an advisor I’ve seen community buzz and hype have a tremendous positive impact. A dedicated community of users and supporters is crucial for the long-term success of any crypto project.

Be sure to increase visibility and brand recognition now. Engage in active marketing and public relations. Some of the best channels to actively promote your project include social media, blog posts and industry events. This could increase awareness of the project and attract potential users and investors.

Conclusion

The halving presents an opportunity to embrace the transformative power of blockchain technology. Exploring decentralized finance (DeFi) applications, non-fungible tokens (NFTs) and other innovative use cases can open doors to untapped potential in the crypto ecosystem.

As the Bitcoin halving unfolds, it is time to prepare, adapt and embark on an exciting journey.

What will you do to tap into the limitless potential of the digital revolution?

For more finance and business tips, subscribe to our weekly newsletter and follow us on X, Facebook, Instagram, and LinkedIn.