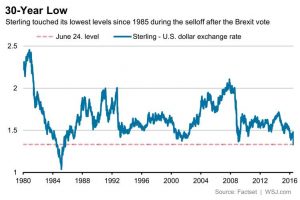

On the 23rd of June, in a historical referendum British people voted to leave the European Union, the so-called “Brexit”. Soon afterwards the pound was plunging against the dollar by more than 10% to $1.32 per pound, which is a 30-year low.

As Europe’s markets opened on Friday the 24th (already referred to as the “Black Friday”), the main stock indices were losing around 10% of their value! Also, oil prices were falling by around 6% (due to risk aversion), the price of gold (a “safe heaven” at times of increased uncertainty) was rising by 6% in dollar terms, the highest increase since the demise of Lehman Brothers in September 2008.

Moreover, investors started “flocking” to the safety of the U.S. Treasuries

In this short article, we will try to briefly review what this “seismic” development might mean for the UK and the world economy.

Short-term effects will be felt through the financial markets

Let us start with the short-term prospects, when Britain will remain a member of the European Union. This means that products can still be imported-exported without any type of restriction, which in turn means that corporate profits are not likely to be seriously affected.

Nonetheless and as already hinted above, the short-run effects of “Brexit” are likely to be felt mostly through the financial markets, where millions of people holding vast amounts of capital will try to assess the values of various assets (e.g. shares, bonds, commodities etc.) for the indefinite future, given this shock.

Looking at the bond markets, which remember were a prime focal point during the crisis of 2011-2012, German bond yields fell to a record low (i.e. their prices went up), whereas the Italian, Spanish, Portuguese and Greek yields all rose (i.e. their prices went down).

Consequently, the spread between the yields of the bonds of these countries and Germany have widened significantly. Thus implying that the market believes that further the Eurozone integration is unlikely, at least at this point in time. This is certainly not a good development for Europe’s peripheral countries.

What else have the markets told us?

The fact that equities fell across the globe might mean that investors are discounting a negative impact on the world economy. However, we need to keep in mind that quite often markets overreact; in reality, Britain is not big enough to affect the global economy as much as say the US or China.

But then again, we need to remember that neither the US nor China has been doing particularly well lately; the US economy has been sluggish and there are serious worries about China’s ability to deal with its huge debts. The effect in Europe is much clearer as Britain is a “consumer” in a high-saving continent.

Obviously, any disruption to the European growth would be particularly problematic now

Turning now to the medium-term effects, where the economic consequences of “Brexit” will become less about financial market swings and more about the real economy.

It is very likely that British companies will face a lot of uncertainty regarding their decision-making process whether we are referring to capital investments or the hiring of new personnel. And this will not only hold for British-owned businesses but also affiliates of international companies that are in Britain.

For example, consider a US company that has its European headquarters in London; does it stay there or does it start making alternative plans (e.g. relocate to Paris, Frankfurt or Dublin)? Also, what about a British company contemplating making a large investment to build a large factory, which will produce goods that will be sold to the E.U.?

These are the type of questions that need to be answered and it is clear that there are no easy answers. One way to deal with this is to take a “wait and see” approach, but such a course of action is likely to hold back economic activity in Britain (and elsewhere) for many months.

“Brexit” comes at an uncomfortable time for the world’s major central banks

Now, the timing of the “Brexit” decision is quite “nasty” for the world’s major central banks as they are usually the first to respond in times of economic distress (recall what happened in September 2008).

Despite the fact that the Bank of England, the European Central Bank and the Federal Reserve have already signaled that they are ready to act, they might be poorly positioned to do so this time around.

Why is that?

Because, on the one hand both the Fed and the ECB are already tilted towards cheap money (actually the ECB has negative rates!) while, on the other hand, the Bank of England must simultaneously plan for a possible recession caused by the “Brexit” uncertainty and for a higher inflation because of the drop in the value of the pound and the outflows of capital.

The Bank of England can fight one of those problems, but it cannot fight both of them at the same time. So, we have an awkward situation here:

A rise in uncertainty and a decline in business confidence, along with a limited response capability by the major central banks!

The long-run prospects: “uncharted waters”

In the long run, it is not parameters like market swings, business confidence or central bank action that will shape the economy but bigger forces that have to do with how Britain – and the European Union – will look like after “Brexit”.

Trying to project that clearly involves a lot of uncertainty since the exact process by which a country may remove itself from the European Union is unclear. We hear a lot about Article 50 of the Lisbon Treaty, which, however, is a very short article (250 words!); not exactly a road map for dealing with such a complicated matter, which touches every aspect of economic life.

It is very likely that the process will take years of hard negotiations

A possibility – the best case scenario – would be for Britain to remain well-integrated within Europe; that is to say model “Brexit” on the basis of Norway or Switzerland, which are two countries that are not part of the E.U. but maintain free trade within the bloc. However, there is a catch here, these countries pay a price for being able to have free access to the E.U market and that price is accepting the E.U. regulations on businesses and allowing free migration from the E.U. member states.

Why might this be a problem?

Simply because the main reasons that Britons voted in favour of “Brexit” were opposition to immigration and regulation!

So, in reality, this possibility would not be a solution to the problem. And that is why we hear many analysts talking about the “uncharted waters”.

Britain is likely to manage the immediate financial turbulence and a possible recession in the medium-term well. However, its longer-term prospects will depend on whether it does everything it can to maintain the current status quo (more or less), which means that it will remain a major international business and financial centre or become a smaller, more isolated country that is likely to be a less important “player” in the world economy.

The point here is that, in reality, it is the second option that would honor the wishes of the British voters…

How do you predict the future of the Great Britain after Brexit? Let me know in the comment section below.

For more finance and business tips, check our finance section and subscribe to our weekly newsletters.